Detailed Notes on Will My Insurance Be Affected When Filing Bankruptcy

Report all lifestyle insurance proceeds you're entitled to or have within your bankruptcy. You may include things like resources acquired immediately after cashing out a complete-everyday living policy and Loss of life Rewards from expression and entire-existence guidelines.

Bankruptcy has major penalties, including harming your credit rating, and you might eliminate some of your property. Nevertheless, for many people, bankruptcy could be the most suitable choice for getting out of personal debt and commencing contemporary.

Chapter thirteen bankruptcy is generally known as reorganization bankruptcy. It will involve making a payment plan that permits you to repay some or all of your current debts about three to 5 years. The payment approach relies on your revenue and bills, and any remaining debts are discharged at the conclusion of the payment program.

Many people Do not file for bankruptcy after obtaining a major everyday living insurance payout or whenever they suspect they might get just one. Why? Due to the fact people who have large quantities of income can pay their debts. They are not bankrupt.

Navigating bankruptcy and its implications on insurance demands watchful lawful and financial steering. Constantly check with with:

When undergoing a bankruptcy, it’s necessary to secure your insurance coverage to make sure you have the mandatory protection when you need it one of the most. Here are some essential procedures that can help safeguard your insurance policies in the course of this complicated time:

Customers can discover appropriate lawyers or workplaces for their lawful issues from your information regarding these lawful support suppliers nearby.

Indeed. You'll report any degree of daily life insurance proceeds you've got in your possession when filing for Chapters 7 and 13. You are going to also disclose any resources you might be owed but have not nonetheless been given.

Being familiar with the implications of bankruptcy on your individual funds is critical for generating informed choices. Should you’re thinking about filing for bankruptcy, it’s necessary to consult which has a bankruptcy legal professional to navigate the procedure properly.

Bankruptcy is a lawful method click now that allows people today or corporations to declare that they can't repay their debts. It’s a proper declaration that you are not able to satisfy your fiscal obligations and that the property are insufficient to go over your debts.

How Will Filing Chapter seven Have an impact on Me? When you file for Chapter 7 bankruptcy, it will have a major effect on your life. The procedure is intended to eradicate most of your personal debt and provide you with a contemporary start off. Nonetheless, it will even have some detrimental effects.

You will not be refunded the premium Resources payments you have already made, and your beneficiaries will not get a Demise advantage during the party within your Demise.

In the event your coverage is left in place beneath the terms within click resources your bankruptcy arrangement, and you will nonetheless find the money for to pay for the rates on that policy, your coverage will continue being set up. Your loved ones also will nonetheless be entitled to get the Demise profit in the occasion of your click for info respective death.

By submitting this type I comply with the Phrases of Use and Privateness Plan and consent to be contacted by visit Martindale-Nolo and its affiliates, and up to a few Lawyers pertaining to this ask for also to acquiring related advertising and marketing messages by automatic suggests, textual content and/or prerecorded messages within the quantity delivered. Consent will not be expected for a ailment of company, Simply click here

Bug Hall Then & Now!

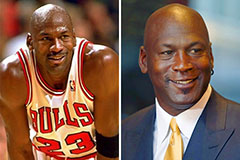

Bug Hall Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!